How to Read an Appraisal Award Letter

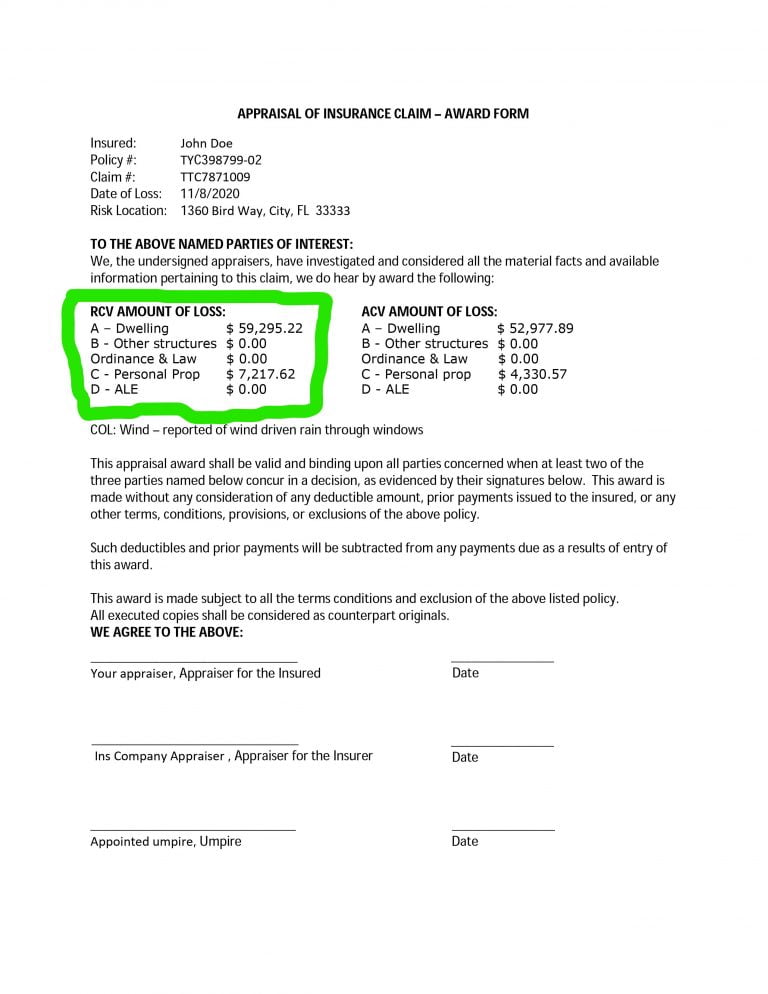

RCV amount of Loss

At some point, you may be looking at the appraisal process and wondering how to Read an Appraisal Award Letter. This is the document that will be signed by the appraisers and potentially an umpire, if your claim goes through the appraisal process.

Florida Allstar Public Adjusting offers appraisal services!

These appraisal awards are confusing for some, so the following is a simple breakdown of what your appraisal award is saying.

Assuming you have RCV coverage on your policy.

Look at the left column where it says, RCV amount of loss. This information on the left shows the appraisal award amount for RCV or “replacement cost value.” They are broken down as coverages A, B, C, D, and ordinance & law. These amounts represent the amount of money you will get IF your policy allows for the replacement cost value of your lost or damaged property, AND you actually replaced the items AND spent up to the RCV amount and provide invoices or proof of your RCV costs.

The easiest way to remember what RCV is, would be to ask yourself what it will cost to “replace” your lost or damaged property in today’s real world marketplace.

In this case, if John Doe replaced his personal property and repaired his dwelling AND spent up to the RCV, then he would get $59,295.22 for damaged dwelling under coverage A, and $7,217.62 for lost or damaged personal property. Again, these amounts are calculated based on RCV, or what it would cost to replace in today’s real world market- place, and requires John Doe to actually spend up to the RCV amount to get this amount from the insurance company.

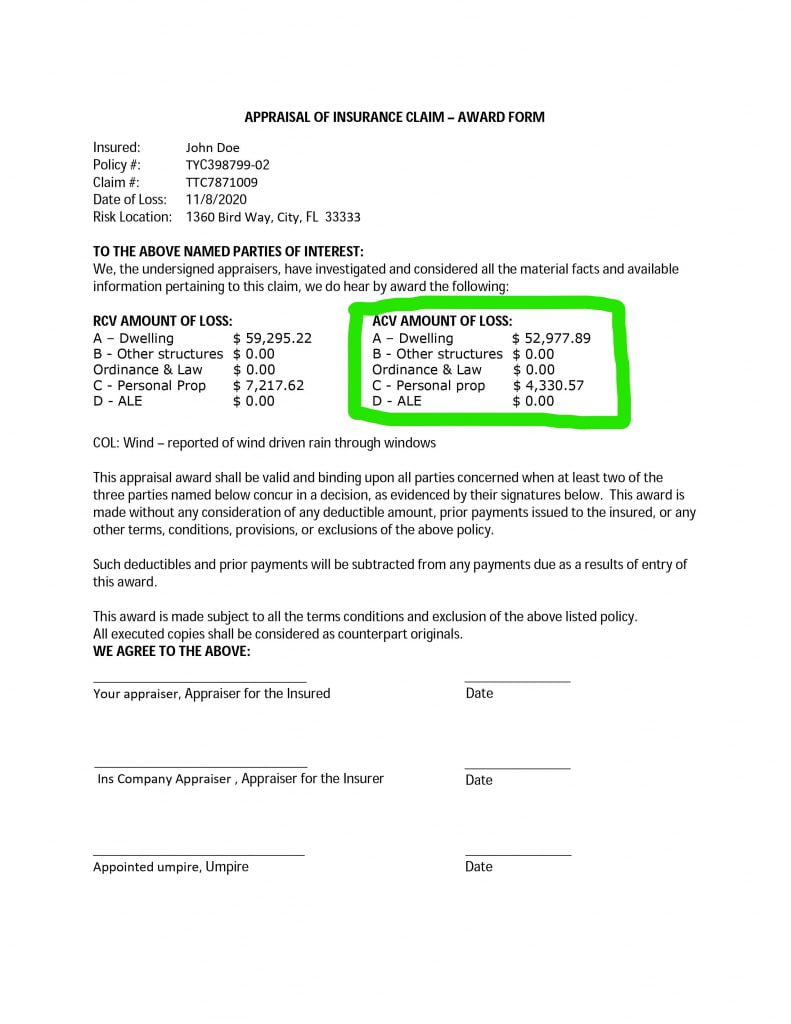

So, what does ACV AMOUNT OF LOSS MEAN?

ACV Amount of Loss

Now look at the column on the right labeled ACV AMOUNT OF LOSS. These numbers are less than the amounts seen on the RCV side. Why? This is because ACV represents the “Actual Cash Value” of your lost or damaged personal property or dwelling. The best way to remember what ACV stands for is that actual cash value is what your items are worth based on its depreciated value, or what it may be worth because of its age. So, in the example on the left, your $7217.62 couch is depreciated to $4,330.57, because it is not new and is aged.

So, what will your payment be when your check finally arrives?

This is how you calculate it.

- Add the numbers in the ACV column and what do you get? $52,977.89 plus $4330.57 which totals $57,308.46

- Now take $57,308.46 and from it, subtract your deductible. (YES, even if they applied the deductible on the original payment.) Let’s say it was $2500. So, $57,308.46 minus $2500 which is $54,808.46

- Now take $54,808.46 and subtract the amount that was originally paid to you For example lets say they paid you $7,898.10. So, $54,808.46 minus $7,898.10 which gives you $46,910.36

- So, $46,910.36 is your new check.

The ACV amount is less than RCV but most of the time, they give you the ability to get the RCV amount through a process called “recoverable depreciation“.

Recoverable depreciation. The difference between the ACV and RCV. How to Claim it!

Are you planning on replacing your damaged items and rebuilding your house? It might seem obvious to most people. Of course! But there are many people who for one reason or another, decide to NOT replace damaged items and there are many people who can do repairs themselves or they decide to do a quick repair of their damage and save the rest of the money for something else. Hey, maybe you now have the money to buy that new pickup truck you always wanted, or maybe you would rather just put the money in the bank and save it. In any case, the insurance company wants to give you incentive to use the money for what it was intended. If you do, the insurance company will then pay you up to the RCV amount.

So here is basically how it works. The ACV in the example above is $54,808.46. Count the deductible here.

Now, what is the gross amount under RCV when you add the amounts in RCV? $64,012.84 (taking out the deducible)

So, for every dollar you spend over $54,808.46(ACV) UP TO $64,012.84 (RCV) you can claim that dollar amount and get it paid to you by the insurance company. The limit, in this case, would be $9,204.38

So, $9204.38 is what you can recover. This is the additional money which would be owed to you if you spend up to the RCV and even more than the RCV. Remember, the appraisal is final. Even if you wind up spending more money, there is nothing you can do about it.

For more information or if you have a claim anywhere in Florida, click here.