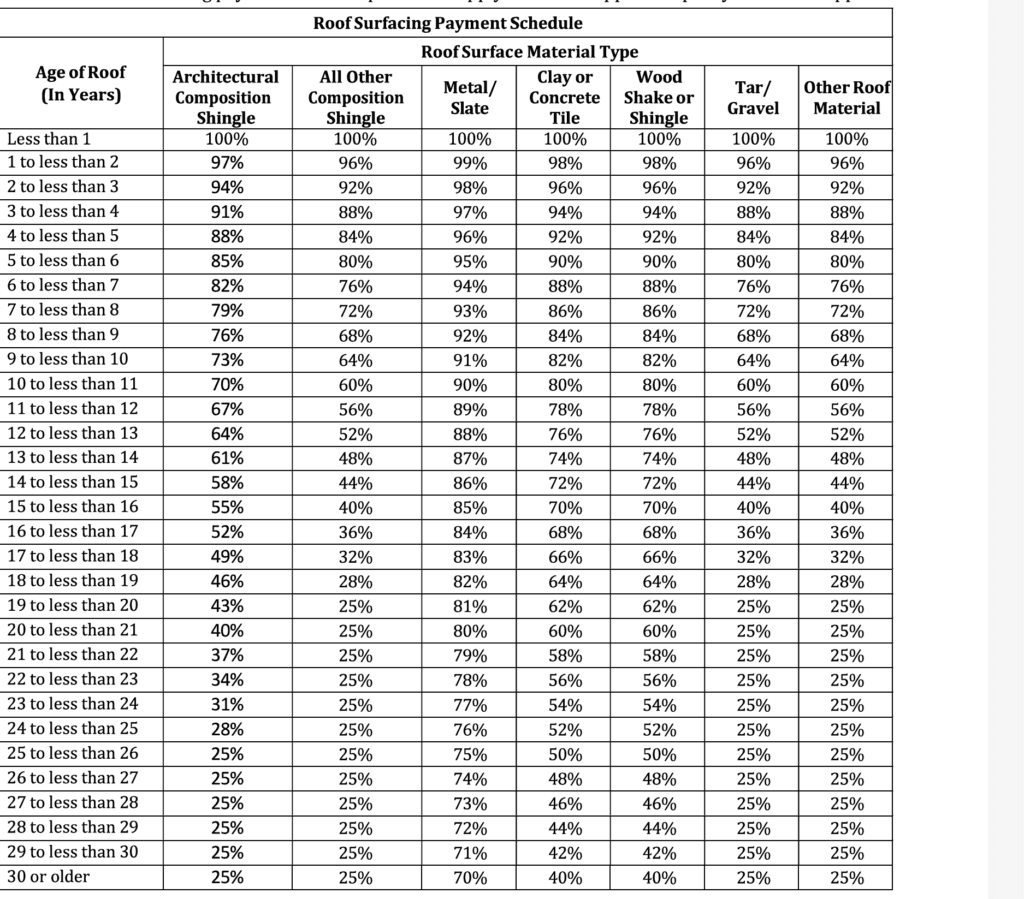

Some homeowner insurance policies sneak in a special Roof Payment Schedule of how roof damage claim is paid. Yes, I say “sneak” because 98% of the claimants with these polices find out AFTER their roof is damaged in a storm that they have this Roof Payment Schedule on their policy. Even though it is the job of the agent to let people know about this, they will never mention it. The only thing they talk about is the price of the policy. It’s cheaper! If you find an insurance company that will write you a policy without replacing the roof, it’s because of this little provision. They are almost happy that you have an old roof! Please see the chart below.

How is ACV Calculated with a Roof Schedule?

The first thing is to know is that ACV means Actual Cash Value. This means that the insurance company has determined in advance based on the roof’s age, what it is worth. Just like an old car, it depreciates more and more as the years go by.

So the question I have is this: If the roof is worth less and less with time, then why doesn’t the insurance company give you a premium reduction on each policy renewal when the ACV goes down?

The chart shows the difference in depreciation between chingle, tile, ketal roofs, and even tar or flat roofs. Tar and flat roofs seem to depreciate the fastest, shingles are next in line for depreciation, then tile and then metal roofs.

Unless you have a metal roof, these types of policies can be very bad in the event that your roof is damaged by a storm and needs to be replaced.

There is an old saying: Pay now or pay later.

See my page on Questions to ask your agent when shopping for a homeowners insurance policy.